Amendment relating to delay in payment to MSME may be counter productive- Jain

The Finance Minister has proposed Amendment of section 43B of Income Tax Act to provide that the amount of purchase of goods or services from MSME will not be allowed as Expenditure if payment is not made within prescribed time limit of 15 days. The time for payment in case of an agreement with MSME may be upto 45 days. The payment beyond the prescribed time may be disallowed under section 43B by the Income Tax Department. In case of Sales tax, GST etc, payment made within due date of filing Income Tax Return is allowed but such relaxation will not be allowed in case of delay in payment to MSME, said tax advocate Narayan Jain addressing a meeting of Rotary Club of Calcutta at Hotel Hindusthan International Saturday evening. In some cases if the delay occurs then the income of the purchaser of goods and services will stand to be enhanced due to disallowance and entail much tax liability, which may not be practical for a business to pay. If the supplier MSME has also purchased from other MSME and the payment is delayed beyond permitted period, then disallowance shall also result in his hands as well thus causing cascading adverse effect, explained Jain. It needs to be reviewed said Jain.

It has also been proposed to tax receipts income from insurance policies (other than ULIP for which provisions already exists) having premium or aggregate of premium above Rs 5,00,000 in a year in case of policies issued on or after 1st April, 2023. Income is proposed to be exempt if received on said Jain. However the receipt will be exempt in case of the death of the insured person.

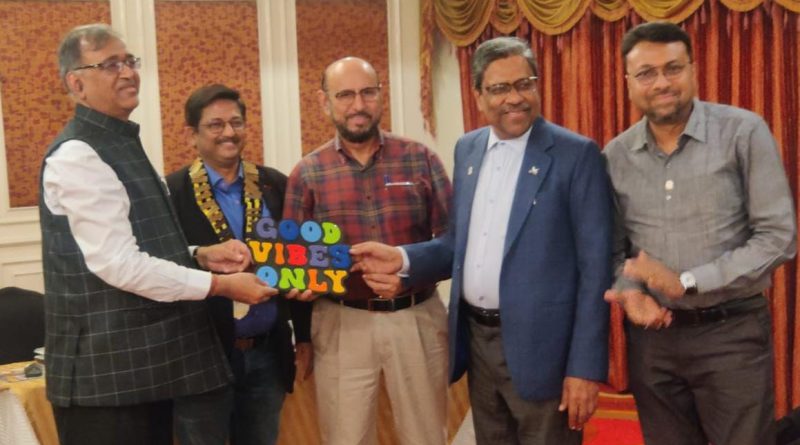

Amitabh Mohan President of Rotary Club of Belur chaired the meeting and Anand Agarwal Secretary thanked all members, on this occasion Ravi P. Sehgal, HK Bubna, RamaLingam, Naveen Khandelwal, SK Lohia, Ajai Agarwal, Ashok Kedia, Ramesh Tewari, Manoj Agarwal, Kishan Kejriwal, Indra Goenka, BL Dugar also actively participated.